Receiving a payslip at the end of each month is a routine for most employees, but understanding what each item on that slip means can be less straightforward. In South Africa, a payslip typically includes various deductions that can significantly impact your take-home pay, also known as net pay.

In this guide, we’ll break down the main components of a South African payslip, explaining each deduction’s purpose, and providing an example payslip layout for easy reference.

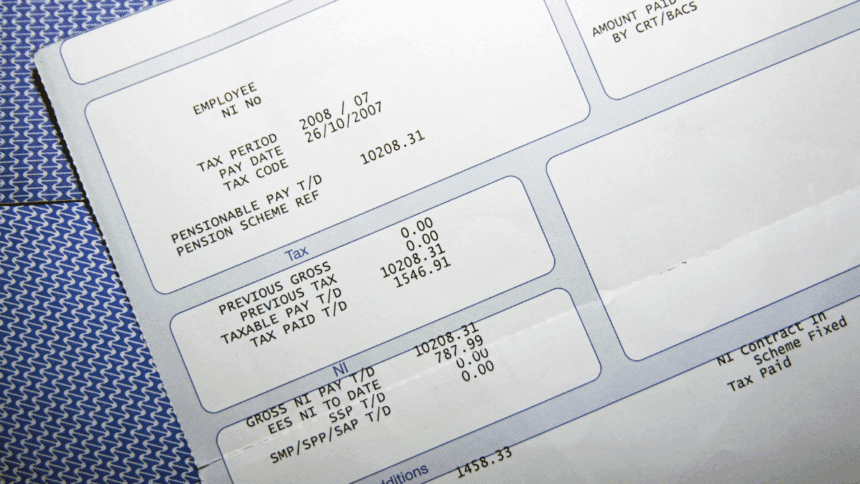

1. Personal Information Section

Your payslip begins with basic details that identify you as an employee. These include:

- Employee Name: Your full name.

- Date of Joining: The date you started working with the company.

- Pay Period: The specific month or period for which the salary is calculated.

- Worked Days: Total days you worked during that period.

These details ensure the payslip is accurately tailored to you and reflects your employment details.

2. Earnings Section

The earnings section lists all income sources provided by your employer. It includes your basic salary and any additional allowances or bonuses. Common entries in this section are:

- Basic Salary: This is the fixed monthly income that forms the core of your salary.

- Incentive Pay: Additional income based on performance, targets achieved, or other incentive structures.

- House Rent Allowance (HRA): A subsidy for accommodation if your company provides it.

- Meal Allowance: Companies sometimes provide a meal allowance, especially if long hours are expected.

- Overtime: Extra pay for any hours worked beyond your usual schedule.

Each of these components adds to your Total Earnings. For example, if your basic pay is R10,000, incentive pay is R1,000, and meal allowance is R200, your total earnings would be R11,200.

3. Deductions Section

Deductions can be mandatory (government or contractual), optional (voluntary), or based on your employment benefits (compulsory). They lower your total earnings to give you your Net Pay or Take-Home Pay.

Here’s an in-depth look at the various deduction categories:

Government Deductions

These deductions are legally required and support public services and social safety nets.

- UIF (Unemployment Insurance Fund): In South Africa, every formally employed person contributes to the UIF, which serves as a safety net during times of unemployment, retrenchment, or parental leave. Both you and your employer each contribute 1% of your gross monthly salary. This means that if your gross salary is R10,000, R100 will be deducted from your salary and another R100 contributed by your employer, making a total UIF contribution of R200.

- PAYE (Pay As You Earn): PAYE is the main income tax collected by the South African Revenue Service (SARS). It’s calculated progressively, meaning your tax rate increases with your income. This tax is directly deducted to fund public resources like hospitals, schools, and roads. Your PAYE rate depends on your income bracket and may be offset by tax credits or deductions, such as medical aid.

Compulsory Deductions

Compulsory deductions are linked to benefits provided by the employer and are usually mandatory under your employment contract.

- Medical Aid Contributions: This deduction goes towards your healthcare plan, often covering you and possibly your dependents. Some employers co-fund this as part of employee benefits, while others deduct the full amount from your salary. Medical aid contributions can reduce your PAYE as they provide tax relief.

- Retirement Fund (Provident or Pension Fund): This deduction goes toward retirement savings, ensuring you have financial security after retirement. Employers and employees typically contribute to this fund, often around 7.5% of your salary, though the rate may vary based on company policy.

- Group Life Insurance: If your employer offers a group life or disability insurance policy, this deduction helps secure financial support for you and your beneficiaries in case of an accident, disability, or death.

Voluntary Deductions

Voluntary deductions are optional and chosen by the employee. They might include contributions to services or memberships that offer additional benefits.

- Union Fees: If you’re a member of a labor union, you’ll see a deduction for union fees on your payslip. These fees support the union’s efforts in representing employees and advocating for their rights.

- Optional Insurance or Savings Plans: You may also opt into additional savings or insurance policies, such as educational plans or retirement annuities, which are deducted from your salary for added financial security.

Contractual Deductions

Contractual deductions arise from legally binding agreements, usually court orders, that the employer must honor.

- Garnishee Orders (Emolument Attachment Orders – EAOs): If you owe debts, a court may order EAOs, previously called garnishee orders. These require your employer to deduct repayments from your salary. They’re enforced by court order and continue until the debt is fully repaid.

- Maintenance Payments: Court-mandated maintenance payments for dependents may also be deducted directly from your salary to ensure you meet legal financial obligations.

4. Net Salary

After adding up all earnings and deducting the various deductions, the remaining amount is your Net Salary or Take-Home Pay. This is the amount deposited in your bank account each month.

For instance, if your total earnings are R11,200 and total deductions amount to R3,000, your net pay would be R8,200.

Sample Payslip with Expanded Deductions

Below is an example of a payslip based on the breakdown of typical deductions:

Company: XYZ Enterprise

Address: 21023 Pearson Point Road, Gate Avenue

- Date of Joining: 5 March 2009

- Pay Period: March 2019

| Section | Description | Amount (R) |

|---|---|---|

| Earnings | ||

| Basic Salary | Fixed monthly income | 9,720.00 |

| Overtime | Additional hours worked | 987.00 |

| Sleeping-out Allowance | Housing support allowance | 586.00 |

| Meal Allowance | Food support | 52.00 |

| Total Earnings | 11,345.00 | |

| Deductions | ||

| Tax (PAYE) | Income tax | 797.00 |

| UIF | Unemployment Insurance Fund | 97.20 |

| Union Subscription | Union membership | 63.00 |

| Funeral and Death Benefit | Group insurance | 53.25 |

| Pension | Retirement contribution | 612.00 |

| Medical Aid | Health insurance contribution | 950.00 |

| Maintenance – Ref 99726 | Court-mandated deduction | 820.00 |

| Furniture is Us – EAO | Emolument attachment order | 195.50 |

| Total Deductions | 3,587.95 | |

| Net Salary | Final take-home amount | 7,757.05 |

Amount in Words: Seven Thousand Seven Hundred Fifty-Seven Rand

Signatures: Employer / Employee

Final Tips for Reading Your Payslip

Understanding each element on your payslip can make a significant difference in managing your finances. Check for discrepancies, and if you notice any unexpected deductions, don’t hesitate to reach out to your HR department for clarification.

Related Content: Cost to Company Meaning: Understanding Your Salary Package Breakdown